Automotive Insurance Telematics (UBI)

Improve risk management, based on accurate data and driving behavior.

Also

Alsoavailable

As an insurance company, you are facing the double-challenge of offering a premium that will attract customers, while minimizing the claim risk.

Your clients are smart, and want to be treated smartly too. That’s why they are looking for a pricing solution, such as dynamic and adapted offers, that will provide them more control and rewards towards their car insurance premium.

IMETRIK's Automotive Insurance Solution enables insurance companies to track and measure clients’ driving patterns in order to provide a usage-based insurance (UBI) program, also known as telematics, black box insurance or PAYD / PHYD / MHYD business models (Pay As You Drive, Pay How You Drive, Manage How You Drive).

It is a win-win for both parties, since the policyholder can control his premium by having a responsible driving behavior, which in turn reduces the reclamation risk for the insurance company.

Most business-critical benefits enabled by UBI:

More accurately priced risk

More accurately priced risk

Changed driver behaviour (improve bad risk)

Changed driver behaviour (improve bad risk)

Reduced claims ratio and cost

Reduced claims ratio and cost

Improved customer retention

Improved customer retention

Attract lower-risk drivers

Attract lower-risk drivers

Others

Others

According to individuals within the Canadian insurance telematics industry.

Source: Telematics Update Canada 2014 (pdf)

Number of UBI Policies in the World

5.5 millions

Source: PTOLEMUS Consulting Group. The state of Usage Based Insurance today, 2014.

UBI Market Penetration: Predictions by 2020

17.4% 13.7% 4.4%Source: PTOLEMUS Consulting Group. The state of Usage Based Insurance today, 2014.

Main Benefits

- 1

Improve risk management.

- 2

Gain market share and new market segments.

- 3

Attract drivers that will generate fewer claims.

- 4

Build customer loyalty by rewarding your best clients.

- 5

Be a key actor in reducing road accidents and impact on environment.

Main Features

-

Kilometers / Mileage Driven

Monitors the distance travelled by the vehicle, on a specific day, week, month or year. The less your customers drive, the less risk they encounter.

-

Harsh Braking & Sudden Acceleration

Gets information when the device detects any unusual braking and acceleration of the vehicle.

-

Time of Day

Gets information about the specific moment of use of the vehicle, so you can provide discounts to customers driving in a less risky period (e.g. day time outside rush hours, and weekends)

Technical Details

-

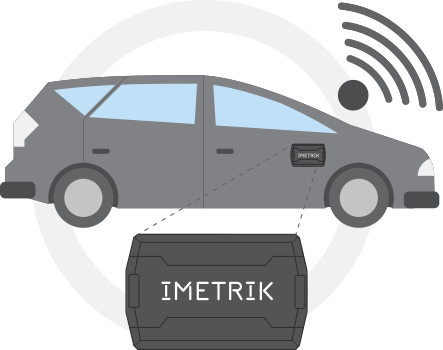

Once the telematics box is connected to the ODB port of the insured vehicle, it will start gathering driving behavior information. This hardware is entirely designed and manufactured by IMETRIK, and can be quickly installed in a vehicle within one minute by the driver himself - IMETRIK also offers a device that can be installed within 15 minutes by a technician, to gather more information.

-

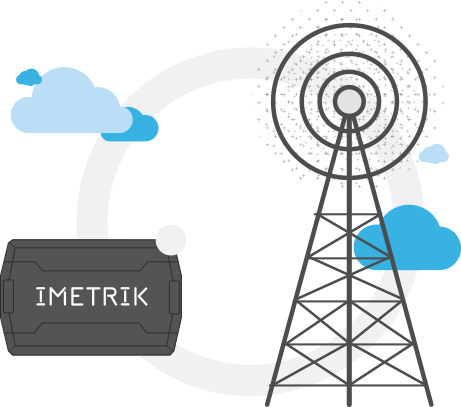

The device will then communicate with the IMETRIK secured web-based application, using mobile networks. IMETRIK operates its own cellular network infrastructure and offers worldwide coverage, thanks to multiple partnerships with various carriers.

-

Insurance companies then have direct access to vehicle information and statistics through our User Interface or APIs, so they can enhance all their business processes, from actuarial science to marketing.